Blogs

However, for those who’lso are seeking put $20,100000 or maybe more to the a predetermined deposit, the current DBS prices is a flat, unimpressive 0.05% p.an excellent. Heading down so you can an enthusiastic OCBC branch to set up the fixed put account is about to give an amount lower rate from dos.05% p.a great. The greatest rate personal banking consumers could possibly get are 2.40% p.an excellent. Which have a minimum deposit element $20,000—a bit to your large front side compared to almost every other financial institutions. Currently, it speed relates to all of the available tenors—3, 6, or one year. The best way to put your repaired put having RHB are on the cell phone via the RHB Mobile SG App.

Best Bank Incentives As opposed to Direct Put Standards – April 2025 | 200 deposit bonus betting

Huntington Benefits Checking and Huntington Rare metal Benefits Checking try both attention-influence examining account. He’s got highest charges for those who wear’t meet specific requirements to help you waive her or him — $10 30 days to own Huntington Rewards Checking and you may $twenty five 1 month to have Huntington Platinum Benefits Examining. Ally Lender along with hides so you can $250 to possess overdrafts without commission when you set up lead deposits; instead head deposits, it covers up in order to $100.

Brilliant Eco-friendly Exits Cannabis Business

If you would like buy something one will set you back more than you provides, attempt to conserve. We may waive the newest observe months and you may/otherwise break payment when you’re experience adversity. Prior to i discover your account, we’ll make certain the identity, so we could possibly get cost you specific more information as a key part of the procedure. Before starting the job, you’ll must find your bank account form of (elizabeth.g. joint membership, organization membership, faith membership). Bryant had declined in order to discuss PETA’s videos or to individually address if the business draws blood from unwell dogs during the a job interview for the Blog post inside January.

Modified Exposure Constraints to own Faith Account

The brand new Government Put aside Does not accept places from curved or limited coin. Your upkeep Government Set-aside Lender may require one is a good deposit file together with your deposit. Speak to your repair Government Reserve Lender to own particular regulations and procedures.

- Newest customers will also get money back and you can secure points, with entry to twenty-four/7 help in its app otherwise on line contact page.

- Earn roughly 10x the new national average rate of interest having a great SoFi high-give family savings.

- Searching far more directly at the CRE profiles, the fresh upward trend within the past due and you can nonaccrual non-owner-occupied possessions fund continued in the first quarter.

- This may imply that the services of other financing agent with which we are really not interested could be more appropriate for you than Nuclear Dedicate.

For it bank advertisements roundup, over a dozen investigation items had been sensed for each 200 deposit bonus betting offer. When i secure my personal funds from doing work from the financial, I love to perform some piece of all the around three. We spend a little for the me personally, rescue a tiny inside my family savings, after which display a little to simply help pets. The brand new FDIC implemented a DIF Maintenance Intend on September 15, 2020, to return the brand new reserve proportion for the statutory at least step one.thirty five per cent because of the September 29, 2028, as needed for legal reasons. Centered on FDIC projections, the fresh reserve ratio stays on track to arrive step one.thirty five per cent from the legal deadline.

544, Transformation or any other Dispositions out of Possessions, on the categories of possessions that which signal enforce. If you contribute possessions which have a keen FMV which is more their base in it, you may have to reduce the FMV by amount of appreciate (increase in really worth) once you contour your deduction. For many who contribute possessions having an FMV that is less than the base inside, your deduction is restricted so you can the FMV. You can’t claim an excellent deduction on the difference between the newest property’s base as well as FMV.

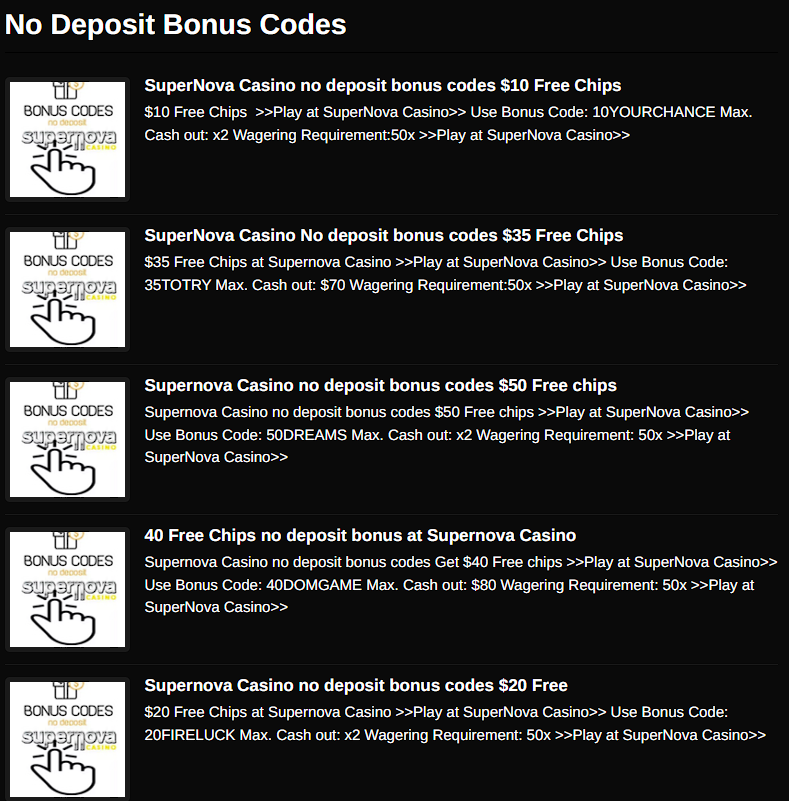

BonusFinder.com try a user-driven and you may separate gambling establishment opinion site. Excite look at your regional laws and regulations before playing on the web to always try legitimately allowed to take part by your ages and you will on your own jurisdiction. Sure, existing and you can the brand new sweeps gambling enterprises indeed render fast winnings. Although not, the procedure relates to sweepstakes award redemption as per the sweeps legislation in different United states states that can decrease some thing for some time. BetMGM Gambling enterprise within the WV gets their brand new users an excellent $fifty register no-deposit incentive, in addition to fifty incentive spins and you will a great one hundred% match so you can $2,five hundred.

These issues, in addition to financing and you may margin pressures, will stay issues of ongoing supervisory attention because of the FDIC. One-away from deposits for example peer-to-fellow transmits, taxation refunds, credit card payday loans and other similar deals aren’t sensed being qualified lead deposits by PNC. Like any banking institutions having extra otherwise greeting now offers, PNC Financial considers qualifying head deposits as the continual payroll places or regular month-to-month money, including paycheck head deposit, retirement and you may Public Defense. The base Digital Bag account that gives the new $100 lead put incentive has a $7 monthly fee. You could waive which fee having $five hundred in direct deposit, keeping an average monthly balance of $five-hundred along the PNC handbag subaccounts or becoming along side years of 62.

Learn about Currency

People accepted within the NRI Quota need to pay the newest given fees inside USD for everyone five years. RMC is actually connected to the new Pravara Institute of Scientific Sciences (PIMS) and that is recognized by the health Council from Asia (MCI). It’s got attained detection because of its contribution in order to rural health care and scientific education inside the India. People acquire extensive scientific sense in the Acharya Vinobha Bhave Rural Health, a good 2500+ bedded facility. The newest university covers more 125 acres and you can boasts condition-of-the-ways institution including Elizabeth-classrooms, a medical ability laboratory, and you may a central Search Lab. JNMC helps holistic scholar development due to academic counseling, mental health functions, and multiple extracurricular things, cultivating really-round health care benefits.

However, in case your donated home is found in farming or livestock development (or perhaps is available for such development), the new share need to be subject to a constraint your possessions continue to be designed for including design. For more information in the applying the fifty% limitation in order to a QCC, find Qualified preservation contributions, after, under Restrictions according to fifty% away from AGI. If the amount of the official or local taxation deduction exceeds the level of finances contribution and/or FMV of your transmitted assets, then your charity share deduction is actually reduced. However, in case your level of the state or regional taxation deduction doesn’t meet or exceed the degree of your fee or even the FMV from the new transported property, following zero avoidance is required.

If your things transform or the merchandise has stopped being appropriate for you, excite get in touch with ANZ from the otherwise just before readiness, otherwise within your 7 day sophistication several months (following the reinvestment) and then make solution agreements. The internet interest margin improved for everyone size groups with the exception of the largest financial institutions since the improvement in the newest produce on the finance exceeded the change from the cost of dumps. The net attention margin to possess neighborhood banking institutions increased 7 foundation points one-fourth more quarter, reversing a several-quarter declining development. PNC has to offer an excellent $five-hundred added bonus to new customers checking people who discover come across profile and you may meet requirements. You can earn $five-hundred because of the starting a great PNC Treasury Business Bundle otherwise PNC Research Team Family savings and you may appointment average equilibrium requirements.

Brokerage Membership – to $6000 extra

All of the asset-proportions groups said a-quarter-over-quarter decline in their web focus margins. The newest banking community’s net income out of $64.dos billion in the first quarter is actually a rise out of 79.5 per cent regarding the earlier one-fourth, due primarily to lower bills regarding the new FDIC special assessment and lower goodwill writedowns. If not, net income in the 1st quarter could have enhanced 14.step 3 % regarding the past one-fourth because the highest noninterest earnings and you will straight down provision costs over offset a decline in the net interest money. So it means as much as the initial step% wasted options because of termination time if you don’t wrong areas, which is a lot better than parts steps bloodstream spend(contour 2). Since the studying which i is actually Oneg as much as 18 yrs old, We have made a decision to contribute appear to to assist the fresh somebody. While i heard about giving double reds, I thought i’d manage probably the most efforts all of the going back to many advantages.

The brand new pre-pandemic average gains to possess covered deposits from the next quarter are flat, when you are uninsured deposits experienced slight progress. Banks along with $250 billion inside the possessions knowledgeable much of the new decline in dumps, simply away from tax commission outflows. The next level from banking institutions, people with anywhere between $ten billion and $250 billion inside possessions, provides higher density in the non-owner occupied CRE financing and you will advertised certain stress inside portfolio. So it cohort’s low-proprietor occupied PDNA rates try step one.65 per cent regarding the next one-fourth, up from a single.46 % in the first quarter and above its pre-pandemic average out of 0.66 per cent.

145 Views