Posts

- Greatest No-deposit Gambling enterprise Incentives in the Canada 2025

- 📜 Small print for it Underdog Fantasy put bonus

- Earliest Secure Bank and Trust pays $a dozen,375 flood insurance policies-associated punishment

- Review of Dumps Survey and you may Filing for Summer 30, 2023

- Albert Fried & Company covers SAR downfalls

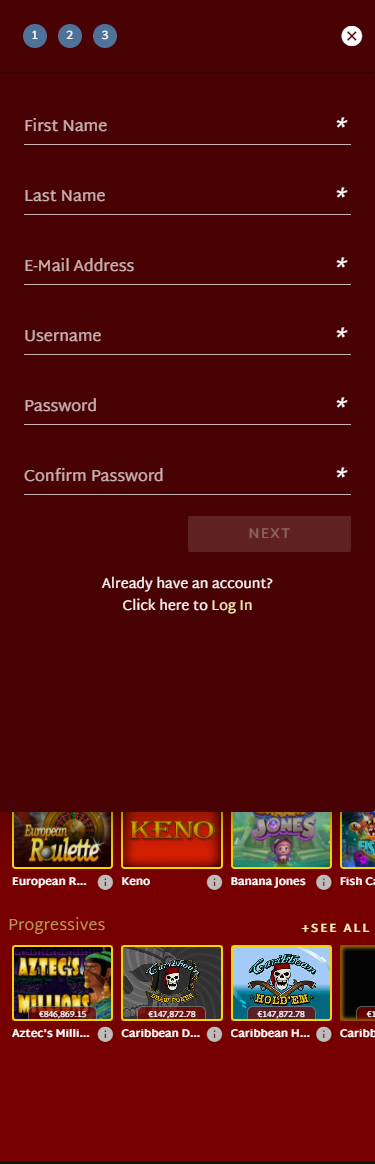

You will never prevent playthrough requirements for the added bonus, like the no-deposit you to definitely, when they expressed from the terms and conditions of the render. For those who on purpose avoid these criteria, you simply will not manage to withdraw the newest profits you’ve received having the main benefit. Do keep in mind that incentive constantly applies to position game which can be dominantly offered since the totally free No-deposit revolves for the particular headings. For the hardly ever times, you could potentially allege a no deposit extra in the form of added bonus dollars to have spending on real time online casino games and you will table game including black-jack and you will roulette.

Greatest No-deposit Gambling enterprise Incentives in the Canada 2025

Appian incorporated Zou, a credit card applicatoin architect, regarding the brand new lawsuit, and then he try bought to spend Appian $5,100. “The fresh appellate legal’s 60-web page choice try unanimous, so we trust Appian would need to beat several, https://mrbetlogin.com/dragon-king/ comprehensive and you may really-reasoned foundation to overturn the newest is attractive legal choice,” Pega additional regarding the statement. Up coming, a panel of around three Virginia Courtroom out of Appeals evaluator inside the July 2024 reversed the newest verdict and ordered an alternative trial, stating that Appian is badly relieved of your own burden of demonstrating one to Pega financially gained from misappropriating Appian’s trading treasures.

📜 Small print for it Underdog Fantasy put bonus

Since the law’s productive go out is retroactive, SSA have to to switch man’s past pros in addition to future benefits. SSA is actually helping most affected beneficiaries now, but less than SSA’s most recent budget, SSA wants you to definitely some cutting-edge times that need to be canned manually might take to one year to modify benefits and you will pay-all retroactive benefits. SSA is currently processing pending or the newest claims to have professionals and you can having fun with automation to pay retroactive advantages and increase month-to-month work for repayments to people whose advantages had been affected by the new WEP and you can GPO.

Earliest Secure Bank and Trust pays $a dozen,375 flood insurance policies-associated punishment

All of the really-known and you will the brand new gambling establishment within the Canada to your No deposit welcome extra choice aims to prompt the brand new participants to store to try out and you may earning actual prizes. This is often anything, including totally free revolves and cash and you will stop to your VIP support system added bonus items that might be subsequent turned into higher honors. The major come across for this few days try Lemon Casino’s 20 100 percent free spin bonus instead of a deposit to your Big Bass Bonanza online slot.

Running times to own CFPB-supervised associations mirror the time from when the newest CFPB efficiency its statements on the FDIC to if the statement of examination are sent to the financial institution. Running moments echo the timeframe from when the field efforts are complete so you can when the report out of examination is distributed to your bank. Great Western Lender, which was obtained because of the First Freeway Lender, are a financial company with cities inside Iowa, Tx, Southern area Dakota and you will Nebraska, as well as a banking place of work inside Scottsbluff, Nebraska. High West Bank’s deposits have been covered by the Federal Put Insurance rates Corporation. The brand new unemployment rates statistics try obtained by the Agency away from Labor Statistics, and you will for instance the PCE price list are used since the an excellent barometer of your state’s financial health.

Review of Dumps Survey and you may Filing for Summer 30, 2023

By using a DINB and you can proclaiming an enthusiastic improve bonus, the brand new FDIC hoped to reduce disruption to possess covered depositors and also to render a way of measuring immediate relief for the uninsured depositors while you are the new agency has worked to resolve the college. The new FDIC did not foreclose the possibility that other organization you are going to purchase the places otherwise property of your own unsuccessful bank, an impractical however, much preferable lead in order to liquidation. Across the sunday, the fresh FDIC positively solicited attention for a purchase and you may assumption of the new failed bank.

Albert Fried & Company covers SAR downfalls

Now, Appian’s desire will be read by the state Supreme Court, the new courtroom decided February 7. It’s the new turn in the fight between Appian, that is located in Fairfax Condition’s McLean area, and opponent Pegasystems. Inside 2022, Appian acquired that was estimated as the greatest award inside the Virginia state court background immediately after it sued Massachusetts-dependent Pega and you may just one, Youyong Zou, inside the 2020, alleging one to Zou, a member of staff of a national builder having fun with Appian software, given Pega with usage of the fresh backend of this app.

The new FDIC and Earliest-People registered for the a loss-express exchange to your industrial finance it ordered of your own previous SV Connection Financial.36 The fresh FDIC since the receiver and Basic-Citizens often show from the losses and you may prospective recoveries to your fund covered by the loss-display contract. The loss-express transaction are estimated to optimize recoveries on the possessions from the remaining her or him regarding the personal business. Your order is additionally likely to remove interruptions to possess mortgage users. To your March 10, 2023, simply over 14 days back, Silicon Valley Bank (SVB), Santa Clara, California, having $209 billion inside the possessions during the year-stop 2022, are signed because of the Ca Service out of Financial Shelter and Invention (CADFPI), and that appointed the brand new FDIC while the receiver.

SSA advises you to definitely, up until it get a notice out of SSA, anyone would be to still stick to the instructions to the Medicare superior expenses and you will spend the money for costs to ensure its Medicare visibility does not stop. SSA will be sending a notification advising someone whenever their Social Protection list is actually upgraded. While the person starts choosing a personal Protection work with, the fresh Medicare advanced would be deducted off their payment per month. If your work for is not adequate to protection the newest Medicare superior, the individual will be charged for the rest.

An important Broker Borrowing Facility now lets qualified primary investors to obtain in the current Dismiss Price for up to 120 days. After that, as the word-of SVB’s problems started initially to bequeath, Signature Bank began to experience contagion outcomes that have put outflows you to definitely first started to the March 9 and became intense to your Friday, February ten, for the statement away from SVB’s failure. On the February 10, Trademark Financial lost 20% of the full deposits inside a question of instances, burning up the cash condition and you can leaving it with a poor balance to your Federal Put aside by romantic of business. It was accomplished that have times to help you free before Federal Set-aside’s cable area closed. Whether you’re not prepared to spend money on a pleasant bonus otherwise have to appreciate video game for free, a knowledgeable no-deposit also offers allows you to discuss the brand new domain of web based casinos to the fair terminology.

“Within the a liquid monetary environment i are still really capitalized and you may all of our better-varied team will bring strength, while we live the reason for permitting generate goals genuine inside the the following half of the new financial year.” As a result of normal on the-web site inspections and make contact with having state nonmember associations, FDIC staff frequently talk to banks in order that its formula to deal with borrowing from the bank chance, liquidity exposure, and you may interest-rates risk work well. In which suitable, FDIC personnel focus on associations having significant connection with this type of threats and you can encourage them to take appropriate exposure-mitigating actions.

Considering Goodman and you may Shaffer (1984), brokered dumps don’t to begin with create to improve productive put insurance rates limitations. Instead, it designed in the new sixties and you may 70s for banking institutions to get time dumps, such as, Dvds, of beyond her field as well as for depositors discover high cost. However,, within the 1982 Penn Rectangular Financial failed, and also the FDIC liquidated it while the FDIC is not able to come across a buyer; proprietors from uninsured Penn Rectangular Dvds got losings.5 This type of losings provided deposit brokers to start splitting up Dvds on the $one hundred,100 increments—the newest FDIC insurance policies limit at the time—to provide a lot more deposit insurance rates. The brand new Federal Set aside System executes economic policy mainly by targeting the brand new government fund speed.

Versus free twist also offers, incentive No-deposit dollars choices during the online casinos try far less popular. Casinos install extra codes to now offers as they allow them to tailor no-deposit incentives in order to a particular representative class. Namely, they may set up a password for cellular local casino pages otherwise the individuals opting for a specific commission method, and because no deposit bonuses try a rareness, codes have been in personal selling. As a result, periodically, incentive codes may not be available within the casinos whether or not they have them.

61 Views